Controversial Characteristics of Fractional Reserve Banking

Chances are, if everyone at your bank decided to withdraw the entirety of each of their bank accounts, the bank would not have enough money at its disposal to meet the demand. This is because banks commonly operate under a fractional reserve banking system. In other words, the bank uses your money however it wants, banking (ahem) on the fact that its account holders won’t protest. Unfair? It sure sounds like it. Stealing? The banks prefer to call it “borrowing.”

What Is Fractional Reserve Banking?

Many people believe that when they deposit money into a bank, the bank keeps all of their money on hand, in a vault, in cash. But this isn’t the way most banks work. According to Investopedia.com, fractional reserve banking refers to a system where banks only back a fraction of bank deposits with actual cash on-hand, available for immediate withdrawal.

This means only a fraction of the money you deposit into your account is required to be available for withdrawal at any given time. For most banks, that fraction is a mere 10 percent of your deposit. So, instead of putting $100 into the vault when you deposit a $100 check, only $10 goes in. That $10 is known as “reserves.”

Surprisingly, many banks are not required to even keep 10 percent on hand — and some aren’t required to keep any reserves at all. Any bank with less than $15.2 million in assets is exempt from keeping any reserves, and those with assets between $15.2 million and $110.2 million are only required to keep 3 percent.

There is an incentive, though, for your bank to keep more of your money in the vault: The Federal Reserve pays out interest on all reserves and excess reserves. The interest is called IOR (“Interest On Reserves”) or IOER (“Interest On Excess Reserves”), and since 2009, it pays out 0.25% at an annual rate.

Is Fractional Reserve Lending a Game of Musical Chairs?

If only a tiny portion of your money is available after you deposit it, then what does the bank do with the rest of it? Much of it is given to other people, in the form of loans.

Simply, banks lend money that they don’t have. They use your money and lend it to someone else, in the hopes that you don’t ask for your money back at the same time that all their other customers ask for theirs. Many consider this to be a fraudulent way to do business, because it would be unheard of to do this at a personal level. It is considered fraud in most states for someone to write a check when they know their checking account does not have sufficient funds to cover the amount. But why isn’t it fraud for a bank to write a loan when payees do have sufficient funds in their accounts to back that loan?

Most banks, even if they are required to have 10 percent reserves on hand, won’t necessarily have it available for you to use — because they’re already lending it out. And so, theoretically, if all of a bank’s customers asked for 10 percent of their account balances, the bank wouldn’t be able to pay that money either. There’s even a term for it — “a run on the bank,” which sounds more like the bank was played a bad card when it’s actually the bank customers who are denied their money.

In essence, if too many customers made a run on the bank, the bank’s attitude would be, “Sorry, but we lent your money to that person over there, and we don’t have it to give back to you.”

In Defense of Fractional Reserve Banking?

Fractional reserve banking is often defended by the argument that the system is the very nature of banks. To quote Forbes, “It’s certainly true that banks could maintain 100% of funds deposited, but if so, they wouldn’t be banks. Instead, they’d be warehouses for money, and those warehouses would charge depositors a fee for the right to deposit with them. Basically money saved would decline day after day and year after year; essentially compound interest in the reverse. Banks would routinely ‘break the buck.’”

Forbes goes on to say that even though a bank may not have enough cash on hand to pay out a demand, they can borrow the amount from another bank. And if that option falls through, the Federal Reserve is there as a last resort.

But the bottom line, for those in favor of fractional reserve banking, is that banking is a business, and so it functions through interest — and that interest is garnered through borrowing and lending money from one party to another. Perhaps the system is imperfect, especially if it experiences bank runs, but such circumstances are considered rare though its a risk most customers are unaware of.

More likely than not, barring any errors made by a teller, your money will be safe in your banking account, ready for you to withdraw as you please. But if you are concerned about an impending national crisis, perhaps you’ll want to take pre-emptive measures by closing your account, cutting a slit in your mattress, and stuffing all your dollar bills inside (preferably in small bills, so that you don’t need to exchange the big ones for bite-sized cash somewhere along the line).

Of course, financial experts would say that this would be an imprudent way to handle your money, and you’d only be hurting yourself — especially in the event of a natural disaster or a robbery. Plus, how else would they be able to gamble with your money and generate exorbitant profits for themselves if they weren’t keeping it “safe” for you.

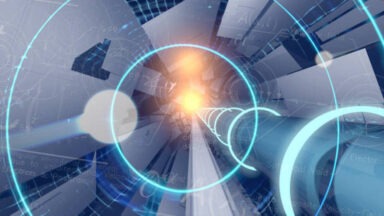

What's Happened Since CERN Fired Up the LHC Again?

The Large Hadron Collider was fired up for the third time, as scientists search for “new physics.”

Run by the European Organization for Nuclear Research, or CERN, near Geneva, Switzerland. The purpose of the collider is to allow scientists to test theories and predictions of particle physics and find new physics.

Completed in 2008, the Large Hadron Collider has had two “operational runs,” from 2009 to 2013, and 2015 to 2018. Now this month, after a long hiatus to improve and upgrade data collection and detectors, the Large Hadron Collider is at it again.

As the journal Nature reports, the first two operational runs tested and explored “known physics.” The discovery of the Higgs Boson particle, or “god particle,” in 2012 was part of that work and reaffirmed current models of how the universe works. This time they are looking for new physics and unknowns such as dark matter.